This review is to touch on the finer points of having and using the MGM Rewards Mastercard. For a full breakdown, check out Bethany Walsh’s full MGM card review on Bougie Miles.

The MGM Rewards Mastercard may seem sleek and flashy. But in keeping with a Vegas theme, it’s a facade fronting a mediocre credit product for even the most ardent of MGM visitors. Although some of the perks are appealing, you’ll find that the mediocre earnings, a shoddy bank interface, and manual redemptions make this credit card a tough sell. Yet, here I am with the card in my wallet.

2024 Promotional Bonus

Until the end of February 2024, there is a “Kickstart Your 2024 Status” promotion. You can earn 10,000 bonus rewards points and 10,000 tier credits after you spend $1500 in the first three months. This could come in handy for those of you who barely missed Gold status in 2023. Normally, the sign-on bonus doesn’t reward additional tier credits. The bonus credits with the accompanying spend should get you about 15% of the way to Gold status alone.

Card overview

MGM’s free credit card has a rewards rate of 3x “points” and tier credits on MGM purchases (1 point and 1 Tier Credit for every $1 spent). Cardholders can get 2x points on gas and supermarket purchases and 1 point on everything else. Gas and supermarkets being the only non-MGM bonus categories feel out of place for a card that may be geared toward travelers. Then again, I trust they know their target market better than I do; this could be a play for locals.

A few perks keep me interested in this card:

- Priority check-in at MGM resorts for MGM Mastercard cardholders (availability varies by resort)

- Complimentary self-parking at Vegas resorts

- Buffet line pass at Vegas resorts.

- 10% earning bonus on points from gambling

I do love skipping lines. Free parking is a benefit of the automatic Pearl Status granted to cardholders. If you’re a Vegas local driving to the Strip frequently or a tourist who regularly rents a car, it can provide some value. Another feature I like is that, as stated before, you earn tier credits with every purchase. So you can generate status on credit card spend. Depending on how many tier credits you’d naturally receive through play and spending at MGM properties, the opportunity cost of pursuing Gold status through spend could be severe. Putting thousands on a credit product that’s hyper-focused on select destinations and credits with limited use cases typically isn’t the optimal strategy. Then again, I’ve been known to do this very thing.

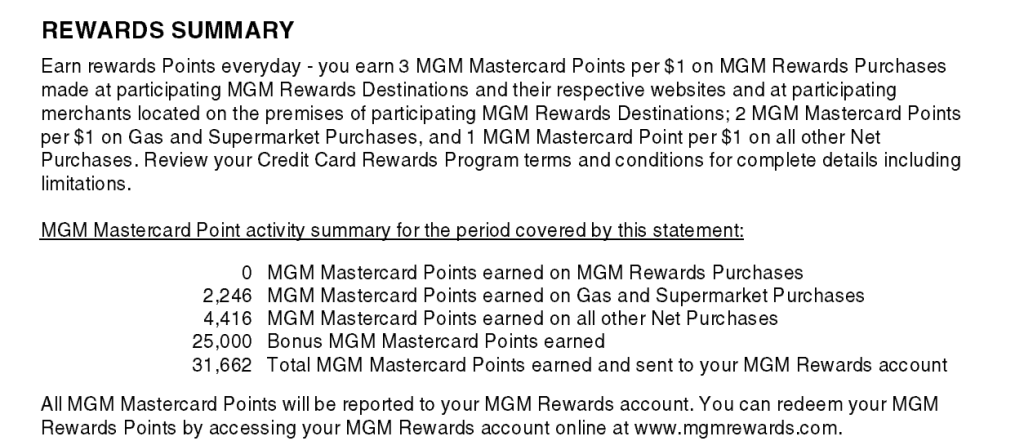

The MGM Rewards Mastercard will usually have some sort of sign-on bonus of extra points if you hit a certain amount of spending in the three months of having the card. When I applied, it was 25,000 points ($250), the highest I had ever seen. 10,000 seems to be the norm. Typically, the bonus is in the form of rewards points, not tier credits. Tier credits are normally only earned on spending. However, the current bonus is an exception.

FNBO platform

The MGM Rewards credit card is issued by First National Bank of Omaha (FNBO), which brings a clunky interface with broken links and mislabeled transactions.

As you can see from the image above, I earned 2246 “MGM Mastercard Points”. I know I spent $0 in gas during this statement period, but I had several transactions during that period that should qualify as supermarket purchases, but my online dashboard doesn’t note a supermarket or grocery category. Anything I would argue for as a grocery purchase, FNBO lists as “Everyday Spending”.

However, when selecting the same purchase on the app, it notes it as a supermarket purchase. I tend to use the mobile app most of the time anyway, but it makes the desktop tracker virtually worthless since no bonus categories are represented.

When you log in on the desktop, there is also what is essentially a dead button that reads “Redeem Reward”. Yet, there are no actual rewards to redeem. The points are automatically deposited into your MGM Rewards account. The button is just a link to MGM Rewards where you can see those rewards accruing. You can’t redeem anything until you’re at an MGM Resort.

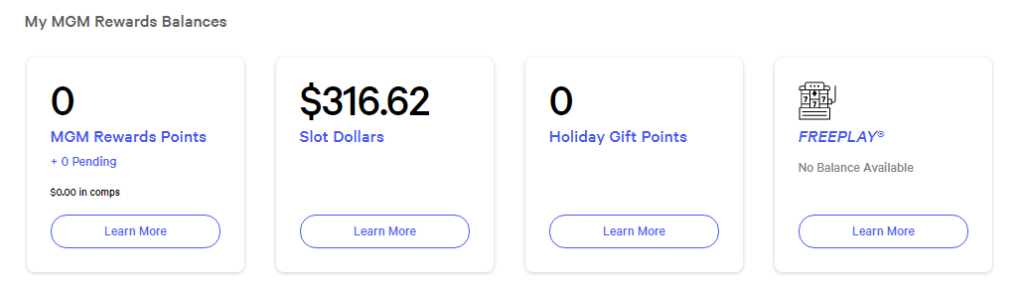

Points deposited as slot dollars

The most confusing aspect of this card is the fact that “MGM Mastercard Points” don’t exist. The Summary of Credit Terms states they’re what you earn with the card, but nothing shows up in your FNBO account online. Instead, your earned tier credits are deposited directly into your MGM Rewards account. So too do the rewards points you earn with the card. But you don’t get a choice as to what kind of points you’re earning or where they’re deposited. Points you earn from the MGM credit card are automatically rewarded and deposited as slot dollars. You can turn those slot dollars into rewards points, but you have to go to an MGM Rewards desk to do so.

To be fair, this is mentioned in the FAQ section on the card page:

MGM Mastercard Points may be redeemed for Slot Dollars or MGM Rewards Points. You can redeem MGM Mastercard Points for MGM Rewards Points by visiting the MGM Rewards desk.

This isn’t intuitive on the platform. Their marketing copy, and the simple act of calling them “MGM Mastercard Points”, seem to imply you’ll have some control of their path to your MGM Rewards account. You don’t for now.

Who is this card for?

If you routinely come close to Gold status and need a tier credit boost, this is a card worth considering. perhaps this is the card for you. Or if you’re a local or frequent visitor who doesn’t mind adding a free card to their portfolio just for some free parking and a few jump-the-line benefits.

It’s tempting to pinpoint where you like to stay and play and get the accompanying card to supplement. But casino cards tend to be bland, poorly executed products. The MGM Rewards Mastercard is no exception.